Untangling the Medicare Mystery: A Guide to Navigating Healthcare Coverage

Medicare can often feel like a labyrinth of complex terms, enrollment periods, and coverage options. Navigating Medigap Coverage Virginia can be daunting, particularly when it comes to understanding the ins and outs of Medicare. Whether you're approaching Medicare age or helping a loved one make informed decisions, this comprehensive guide aims to untangle the Medicare mystery and provide a clear roadmap to finding the right coverage for your healthcare needs.

Health insurance plays a crucial role in safeguarding our well-being, and Medicare is a federal program that provides healthcare coverage for individuals who are 65 years or older, as well as certain younger individuals with disabilities or specific medical conditions. Enrolling in Medicare involves understanding the different parts and options available, including Medicare Part A, which covers hospital stays and some skilled nursing care, and Medicare Part B, which covers medical services like doctor visits and outpatient care. Additionally, there's Medicare Part C, known as Medicare Advantage, which combines Parts A and B along with additional benefits, and Medicare Part D, which covers prescription drugs.

Understanding the Basics of Medicare

Medicare is a comprehensive health insurance program in the United States that provides coverage to individuals who are 65 years of age or older, as well as certain younger people with disabilities. Understanding the basics of Medicare is essential for navigating the complexities of healthcare coverage.

There are four primary parts of Medicare: Parts A, B, C, and D.

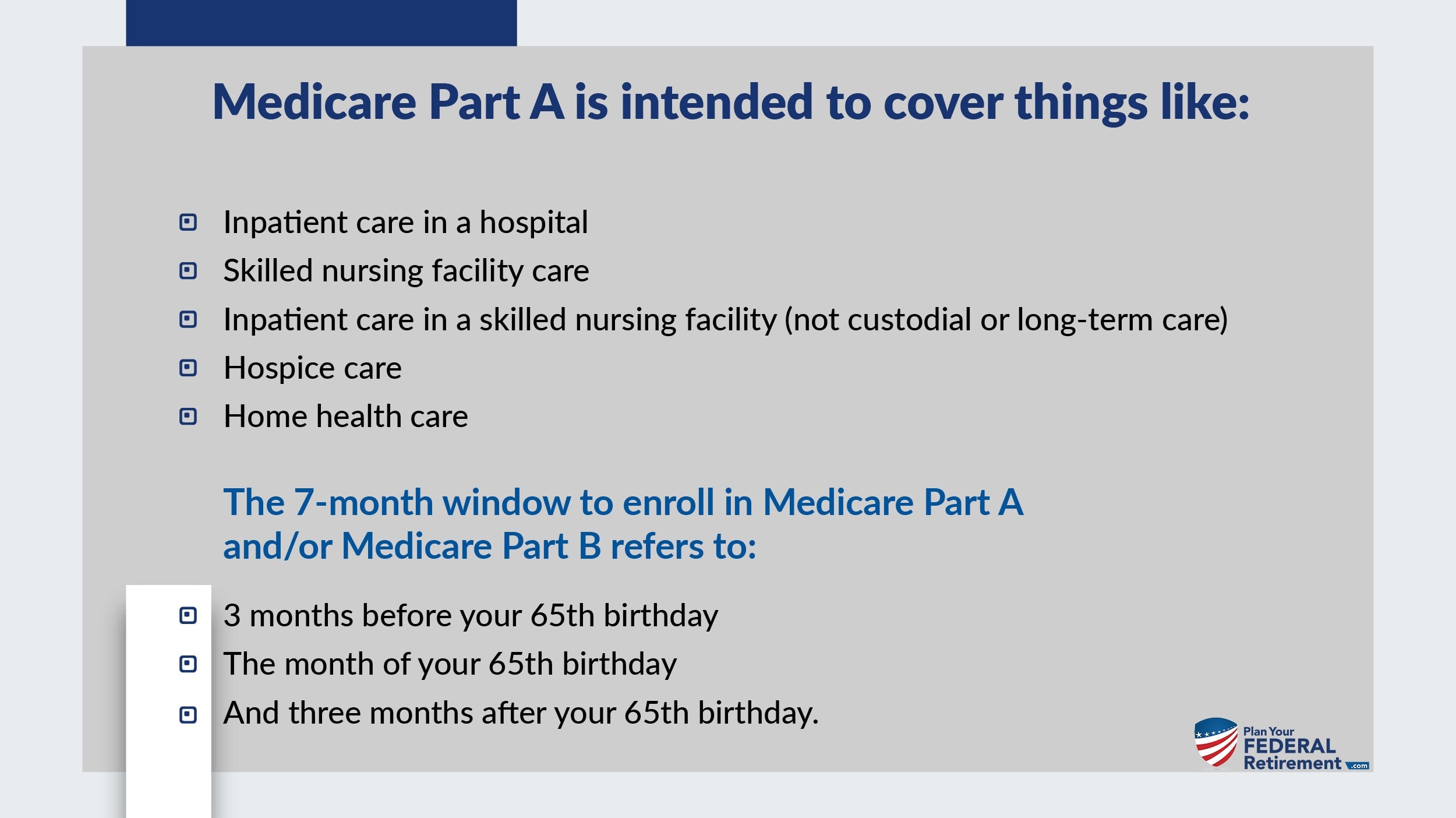

Medicare Part A is often referred to as hospital insurance. It helps cover inpatient hospital stays, skilled nursing facility care, and some home healthcare services. Most people do not have to pay a premium for Part A if they or their spouse has paid Medicare taxes while working.

Medicare Part B is medical insurance that helps cover services from doctors, outpatient care, preventive services, and medical supplies. Part B usually requires a monthly premium, which is based on income and may be deducted from Social Security benefits.

Medicare Part C, also known as Medicare Advantage, is a way to receive Medicare benefits through private insurance companies. These plans often include Part A, Part B, and sometimes Part D coverage. They may offer additional benefits such as vision, dental, or hearing services.

Medicare Part D, on the other hand, is prescription drug coverage. It helps pay for prescription medications and is available as a standalone plan or as part of a Medicare Advantage plan. Part D plans are offered by insurance companies and other private companies approved by Medicare.

Understanding these basic components of Medicare is crucial when considering enrollment, coverage options, and associated costs. It's important to note that original Medicare consists of Parts A and B, but additional coverage can be obtained through Medicare Advantage plans or Medicare Supplement Plans (also known as Medigap). Stay informed about Medicare eligibility, enrollment periods, and the various programs available to ensure you make the right healthcare decisions.

Exploring Different Medicare Plans

When it comes to choosing the right Medicare plan, it's essential to understand the options available to you. Medicare offers several different plans for individuals seeking healthcare coverage. Let's take a closer look at the different Medicare plans and what they entail.

1. Original Medicare (Parts A and B): Original Medicare is the traditional healthcare coverage provided by the government. Part A covers hospital services, while Part B covers doctor visits and outpatient care. This plan allows you to see any healthcare provider that accepts Medicare.

2. Medicare Advantage (Part C): Medicare Advantage plans, also known as Part C, are an alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare. Medicare Advantage plans often include additional benefits, such as prescription drug coverage and dental or vision care.

3. Medicare Prescription Drug Plans (Part D): Medicare Part D is available to individuals who have Original Medicare or a Medicare Advantage plan that does not include prescription drug coverage. These plans cover the cost of prescription medications and are offered by private insurance companies.

Understanding the different Medicare plans can help you make an informed decision about the coverage that best suits your healthcare needs. Whether you prefer the flexibility of Original Medicare or the added benefits of Medicare Advantage, evaluating your options is crucial in ensuring you find the right plan for you.

Making the Most of Medicare Coverage

When it comes to Medicare, understanding your coverage options is crucial for getting the most out of the program. Medicare offers a range of plans and enrollment periods that can help you tailor your healthcare coverage to meet your specific needs.

One important aspect to consider is the choice between Original Medicare and Medicare Advantage. Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance), provides coverage for hospital visits, doctor visits, and medical services. On the other hand, Medicare Advantage (Part C) plans are offered by private insurance companies approved by Medicare and provide all the benefits of Original Medicare, plus additional coverage such as prescription drugs, dental, vision, and hearing.

Another key decision is whether to enroll in Medicare Part D, which covers prescription drugs. Part D plans are provided by private insurance companies and can help significantly reduce medication costs. It's important to review different Part D plans to ensure they cover the specific prescription drugs you need at a cost that fits your budget.

Additionally, Medicare Supplement Plans (also known as Medigap) can help fill the gaps in Original Medicare coverage by covering out-of-pocket costs such as deductibles, copayments, and coinsurance. These plans are offered by private insurance companies and are designed to work alongside Original Medicare.

To make the most of your Medicare coverage, understanding the different enrollment periods is also crucial. The initial enrollment period is when most people first become eligible for Medicare and lasts for a total of 7 months. This period begins 3 months before the month you turn 65 and ends 3 months after your birth month. It's important to enroll during this initial enrollment period to avoid any potential late enrollment penalties.

Finally, taking advantage of Medicare Benefits and Savings Programs can help lower your healthcare costs. These programs are specifically designed to provide financial assistance to individuals with limited income and resources. Some of these programs include the Medicare Savings Programs, which can help cover Medicare premiums and potentially other costs, and the Extra Help program, which assists with prescription drug costs.

By considering your options, understanding enrollment periods, and utilizing available resources and programs, you can navigate the Medicare system more effectively and make the most out of your healthcare coverage.